Spotting Trends and Narratives In Crypto 🔍

Let us uncover what narratives are, how to spot them, what to look forward to, and how you can use them to finally realize your dream of turning a profit in crypto.

Ever wonder why some people make a killing off of crypto, and you’re still trying to recover the $200 you lost in meme coins in 2022?

While you might attribute this to luck, that’s not the case. Almost everyone who has built a killing off of crypto has done so by following the narratives and following trends.

Let us uncover what narratives are, how to spot them, what to look forward to, and how you can use them to finally realize your dream of turning a profit in crypto.

Identifying a Narrative

So, what exactly is a narrative in crypto?

Think of it as the captivating plotline that shapes the entire mood and sentiment of the market.

It's the story that everyone's buzzing about, the driving force behind market moves. So, how do you keep up with all the crypto narratives that are floating around?

Through observation: In an industry that generates tons of content online, all you need to do is observe. Follow the trendsetters and thought leaders of the crypto community. Look for those crypto bros that have everything figured out.

Just get fixated on everything crypto and keep yourself focused like a hawk, any controversy, any development, any big break in crypto happens, you should know about it. Within a few weeks, you’ll get the hang of it and develop an intuition about what works and what doesn’t.

Performing Narratives

Now, let's talk about the rockstars of crypto narratives. DeFi and NFTs are stealing the show – the cool kids in town.

DeFi promises financial inclusion for all, and NFTs are like digital treasures. But they’re the mainstream ones; you’re not likely to win very big with these.

However, under the radar but full of potential narratives like blockchain interoperability and sustainability, they have well-exceeded expectations and realized massive returns. Solana is banking hard on long-term blockchain sustainability, which has developed narratives like layer 1s + more.

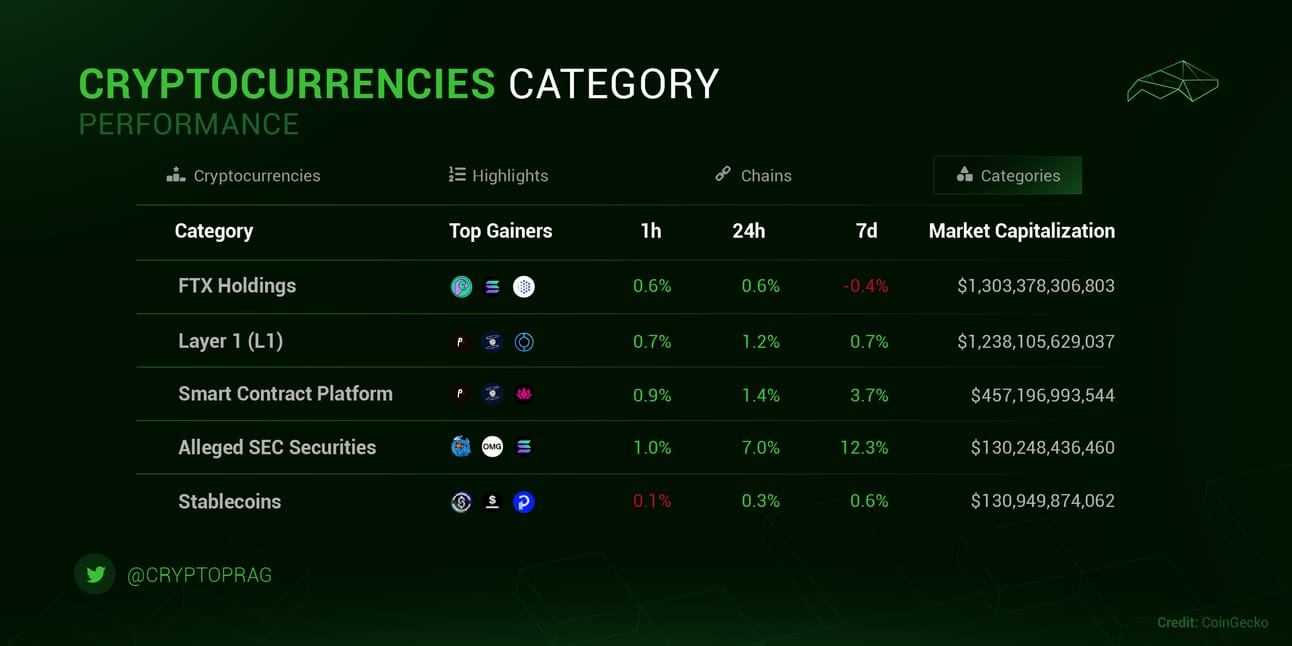

Spotting Trends with Data

You might have seen those online crypto gurus throwing big words around like trading volume, moving averages, Fibonacci Retracements, etc. They might seem too challenging to understand, but they’re just fancy words for data-driven insights that will help you predict how the market is moving.

You need to look at data through a different lens. There’s a lot of data out there, and to extract actionable insights from the data, you need to learn how to analyze that data effectively. There are a lot of resources online that will help you in learning these techniques. Don’t be intimidated by these fancy words; they’re just cool names given to simple yet powerful tools that can empower you to make informed decisions in crypto.

Bubblemaps | Footprint Analytics | Etherscan | DEXTools

Trends in Q1/Q2

2023 was a bust for crypto for the most part; however, 2024 promises some thrilling opportunities in the crypto field. In the first half of 2024, the tokenization of Real-World Assets and Crypto ETFs will be the It trends.

Platforms such as Polygon and Untangled Finance are pushing the boundaries of RWA tokenization, elevating the potential of digital assets. Concurrently, BlackRock's pursuit of US government approval for Crypto ETFs speaks volumes about the growing mainstream acceptance of cryptocurrency.

How institutional adoption of Bitcoin ushered a bull run in 2020-21, these trends ought to do that in the first two quarters of this year.

Strategy for Narrative & Trend Spotting

The best strategy for narrative and trend spotting is consuming content. Consume all kinds of information that is available out there for crypto. Read daily crypto news and join crypto communities online on Reddit and Twitter. Then, use that information and the data-sorting techniques to curate your portfolio and start investing. Remember, you will only learn about the perfect strategy if you start investing!

Stay nimble and adapt your strategy as the market script unfolds. As you proceed further in the jungle of information, everything will make more and more sense.

In Conclusion:

In a nutshell, riding the crypto wave is all about feeling the market's pulse through gathering as much information as possible. Then, use that information combined with careful data analysis to make focused decisions. Stay curious, stay informed, and get ready to ride those trends!

If you enjoyed this read, tap into our social platforms for more alpha👇

Twitter❌ | Telegram Chat💬 | Telegram Channel📣