Why FDV Is The Meta Game🧠

Fully Diluted Valuation (FDV) is an important metric in the cryptocurrency world, showing the total market capitalization if all tokens were in circulation.

If you've invested in a blockchain project recently, it’s likely that the asset has a fully diluted valuation (FDV) significantly larger than its current market capitalization. This discrepancy often indicates potential long-term issues, as many projects today circulate only a small fraction of their total supply initially. Due to vesting schedules, ecosystem rewards, and staged airdrops, the circulating supply often increases dramatically over time, diluting value.

Key Takeaways🍿:

Many new cryptocurrency projects have a small fraction of their total supply initially in circulation, leading to a high FDV.🔺

A high FDV compared to the current market capitalization can indicate impending inflation and potential value erosion.⌛️

Understanding FDV is crucial for navigating the blockchain landscape and making informed investment decisions.🧠

What Is FDV and Why Does It Matter?

Fully Diluted Valuation (FDV) is an important metric in the cryptocurrency world, showing the total market capitalization if all tokens were in circulation. It is calculated by multiplying the total supply of tokens by the current market price.

FDV matters because it helps investors understand the potential future value and inflation risk of a project. High FDV compared to the current market capitalization often indicates that a project will face significant sell-side pressure as more tokens are released, which can drive prices down.

Successful projects like Ethereum, Binance Coin, and Cardano launched with large portions of their supply already in circulation, keeping inflation manageable.

Recent Launches Have Low Circulating Supplies

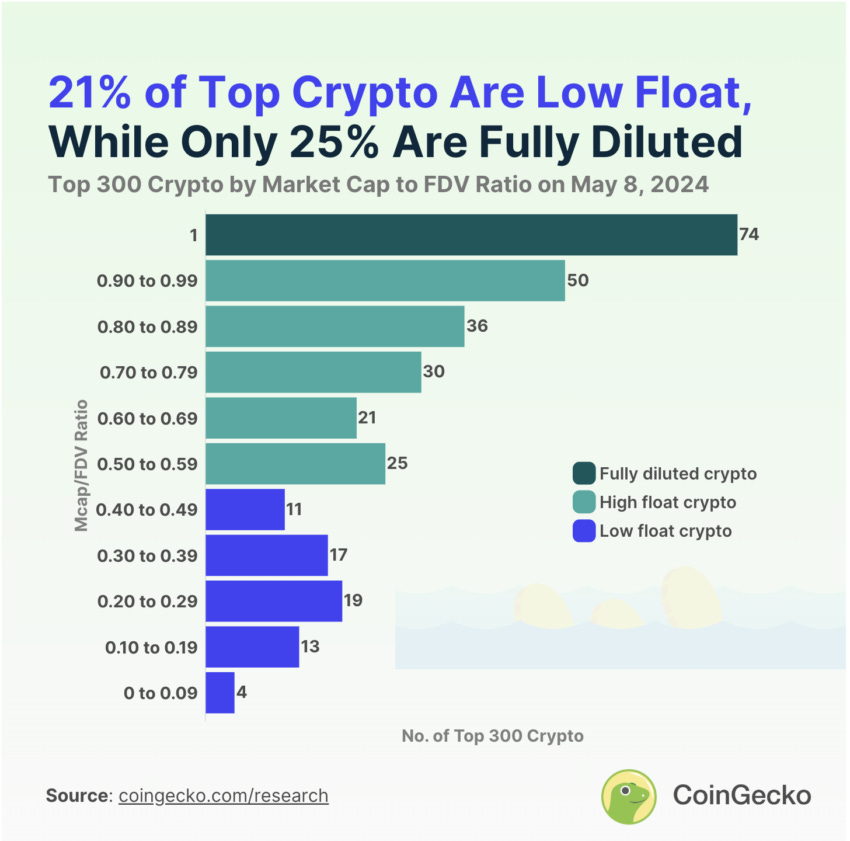

Many new cryptocurrency projects are launching in a way that puts investors at risk. Data from CoinMarketCap and Token Unlocks shows that these tokens often start with a small amount of their total supply available to trade but are valued very high. This setup can be risky for investors.

A report by Binance Research reveals that between 2024 and 2030, about $155 billion worth of tokens will be released into the market. This could lead to a lot of sell pressure unless there is a big increase in the buy-side demand, which is less likely.

Why FDV is the Meta Game

Many tokens launched in 2024 have a high FDV but only a small portion of their total supply is available to trade, often less than 20%. This means these new tokens have very high valuations compared to more established cryptocurrencies, even though they might not have many users or proven value.

This is a problem because the increased supply can drive down the token's price. Investors who bought early might face big losses as more tokens come into the market and their prices fall. According to a Binance report, these tokens would need about $80 billion in new investments keep their prices stable in the coming years. This is a tough goal, especially with the ups and downs in the crypto market.

Understanding FDV is essential for you to navigate the modern blockchain landscape. A high FDV relative to the current market cap can indicate impending inflation and potential value erosion. The FDV/Market Cap ratio is an important metric to keep note of. It gives a sense of a sense of how much more a token's supply could increase.

A high FDV/Market Cap ratio signals the potential for inflation as a significant portion of the token supply remains unreleased, leading to increased selling pressure from early investors and a risk of price decline due to the growing circulating supply.

Conversely, a low FDV/Market Cap ratio indicates limited inflation, offering price stability with fewer new tokens entering the market and making it attractive for long-term investors seeking stable growth with reduced risk of devaluation.

It’s important to note that this research was written for the sake of education and pure entertainment value!

Please DYOR on every project, and remember, this is not investment advice🙏

If you enjoyed this read, tap into our social platforms for more alpha👇

Twitter❌ | Telegram Chat💬 | Telegram Channel📣